A Remedy to the Three Cups of Tea Problem

Philanthropic Investment Management: a Rigorous Practice that Minimizes Fraud and Waste

Last Sunday, 60 Minutes ran a story questioning the veracity of Greg Mortenson’s phenomenally successful memoir, Three Cups of Tea. The investigation was spurred by complaints from former board members and donors to the NGO Mortenson founded, the Central Asia Institute.

There is substantial evidence of exaggeration in the memoir and misuse of precious donor funds. Throughout the past week there’s been the usual panic among charities: what if we all get tarred by the same brush? There’s also mounting evidence that the failings of the Central Asia Institute took place in a far more complex environment than the 60 Minutes story suggested. No one ever accused the 60 minutes team of embracing gray areas.

For us, there are two great lessons emerging from the 3 Cups of Tea scandal.

Lesson 1: Build it, and they might not come.

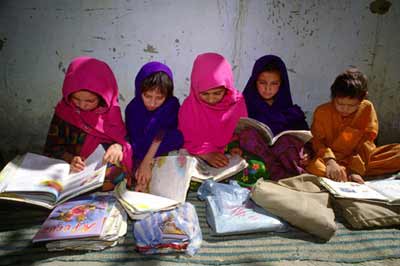

Building things is often the easiest part of a project in the developing world. But making these projects–schools, hospitals, wells, businesses– work, aligning them with local desires and cultures and business environments–that is very, very hard. That is the heart of the work. The fact that some of the Central Asia Foundation’s schools are failing is no surprise to anyone who’s worked in the field.

Lesson 2: Donors don’t do enough due diligence, and NGOs aren’t rigorous enough about disbursing grant funds (let’s call it making philanthropic investments).

It’s one thing to have a project fail to meet it’s goals. It’s quite another to misspend funds. For the past two years, Schaffer&Combs has been working on a new model of grant-making. We call it Philanthropic Investment Management (PIM). It’s not exactly rocket science, as they say, but in terms of due diligence, the setting of metrics and performance goals, and constant review and flexibility, the practice resembles that of the most rigorous, nurturing early venture capital models.

We created this practice expressly to avoid the the situations that lead to unused or misdirected resources.

We do a lot of due diligence before committing donor funds. We review programs in person, on the ground, every quarter (S&C partner James Schaffer is in Kenya at this writing performing formal investment reviews of two client projects that are functioning under the PIM practice).

We also make it a habit of being willing to talk not only about what is working, but also what hasn’t worked, what needs improvement. This is the way you improve programs, build donor trust. Successful grant-making is hard work, and like building any business, the path is not always smooth. Every sophisticated donor knows that.

Neither we nor our non-profit clients has Mr. Mortenson’s fame. We have to earn donor trust based on our performance. And we’re building structures and practices that demonstrate the rigor and accountability those donors deserve.

We view these episodic charity scandals not as a threat, but as an opportunity to point out that our clients do not, and will not engage in the loose and fast practices that so often result in misspent funds, broken donor trust, and poorly designed programs. If our programs underperform, it’s because the tasks are so challenging, not because we failed to mind the shop.

Recent Posts

- Our Search Division is Ramping Up to Meet Increasing Demand for Talented, Purpose-Driven Executives

- 2020 Demanded Smart Strategies From Every Organization – Here’s What We’ve Been Working On

- S&C supports major new alliance in apparel industry

- Call it What it is: Power

- Schaffer&Combs places Higg Co’s incoming Vice President, Marketing & Communications and Senior Manager Sales

Recent Comments